One of Berkshire’s largest investments ever was the $16.9 billion in buybacks the company made in the first three quarters of 2020.

Mr. Buffett had shunned buybacks for years before starting to slowly take them fairly recently.

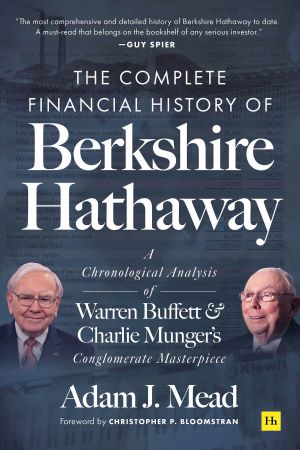

“I think it’s in fact far more intelligent use of capital than dividends,” said Adam Mead, chief executive and chief investment officer of Mead Capital Management LLC and author of the forthcoming book “The Complete Financial History of Berkshire Hathaway.”

Mr. Mead said the last time Berkshire gave dividends was 1967 and he doesn’t expect to see a return to them. “I would be very surprised to see a dividend during Buffett’s tenure at the helm.”